missoula property tax increase

The notices for the 2019-2020 appraisal cycle are. Missoula County collects on average 093 of a propertys assessed fair market value as property tax.

Property Taxes Missoula County Blog

The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700.

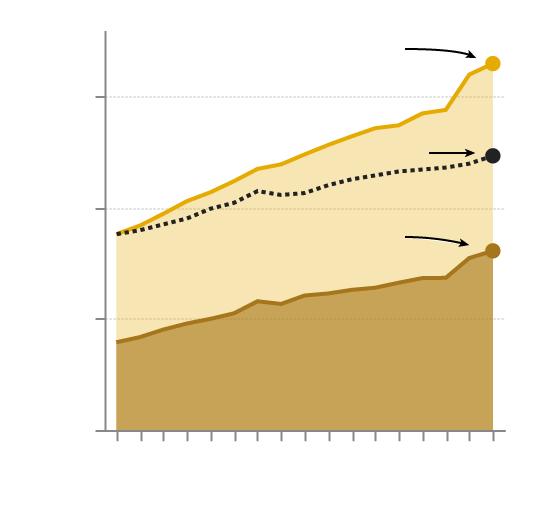

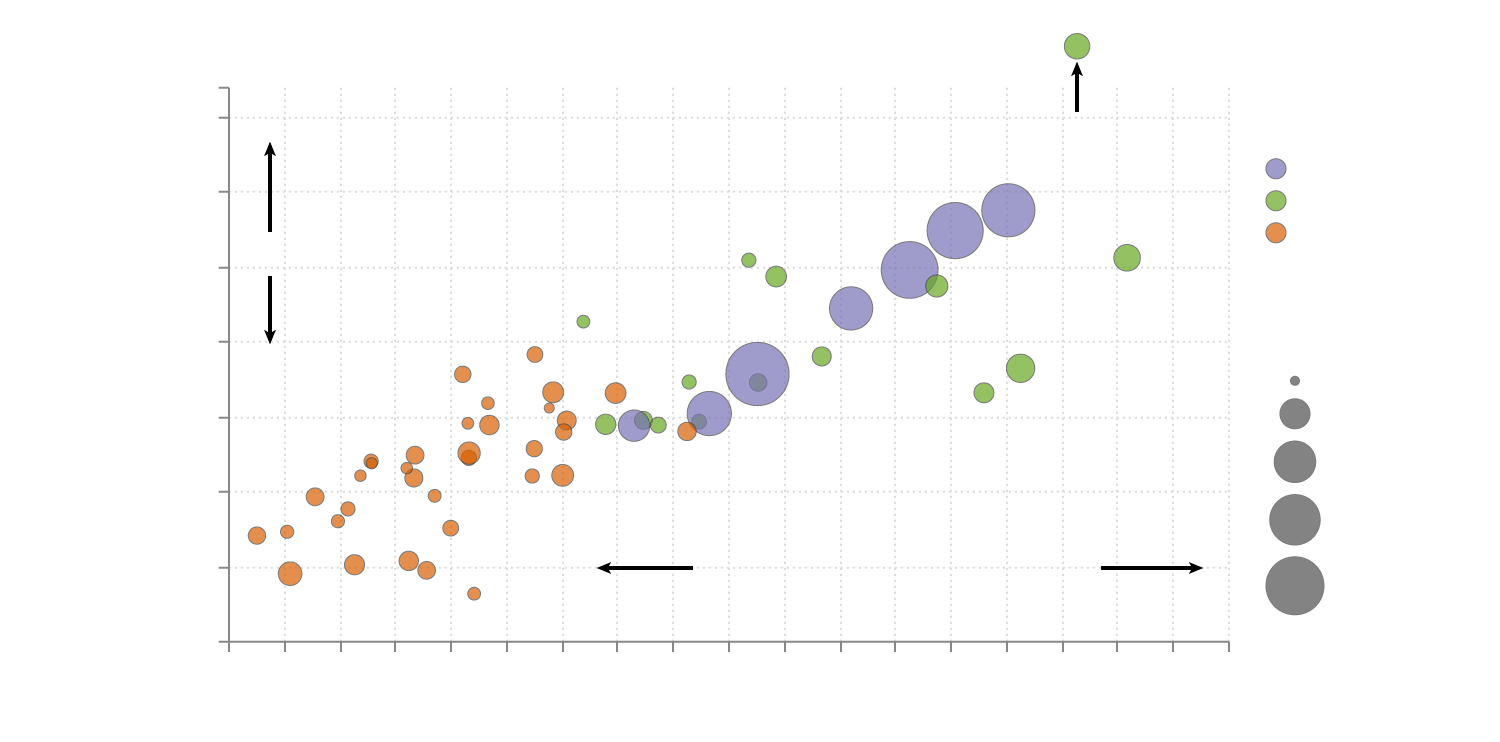

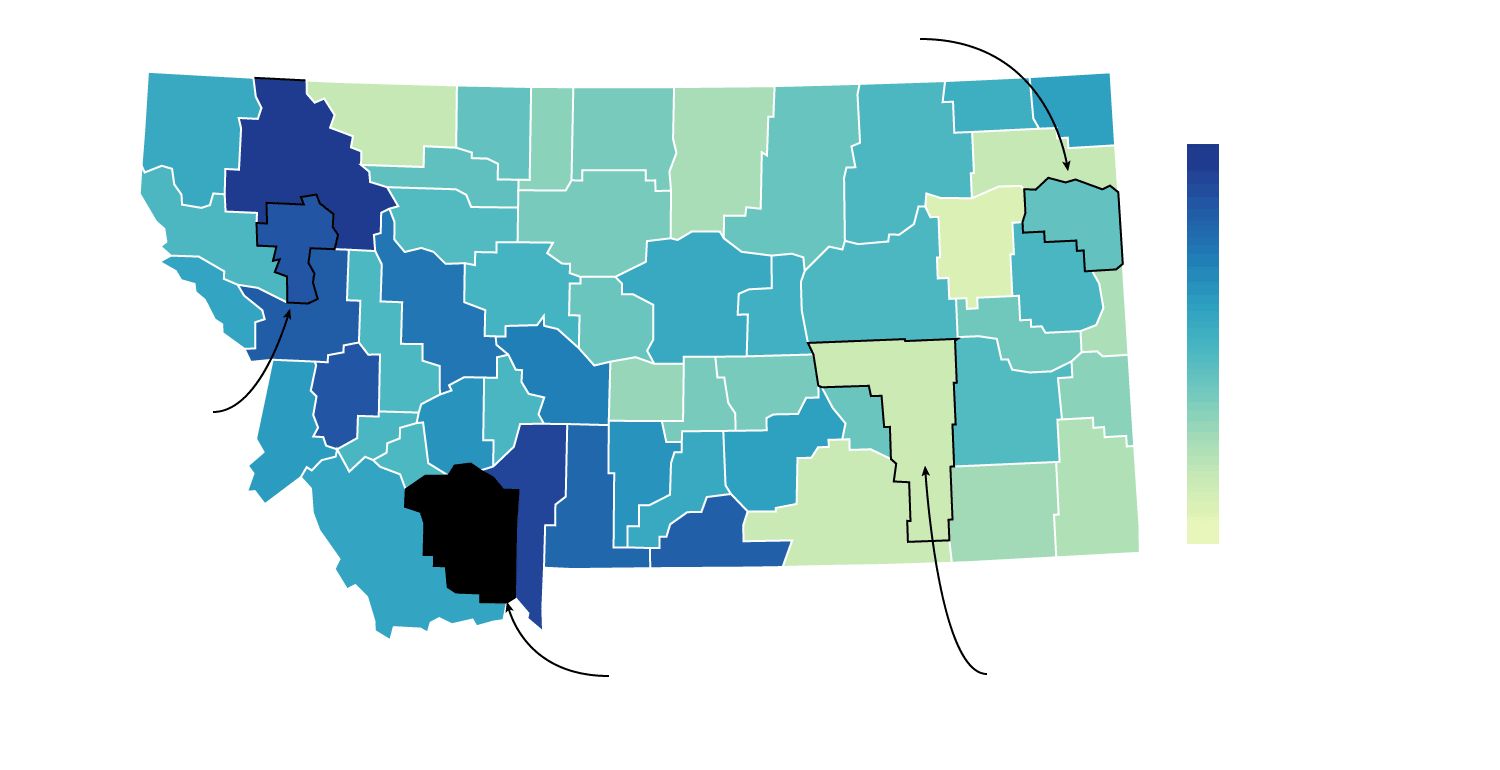

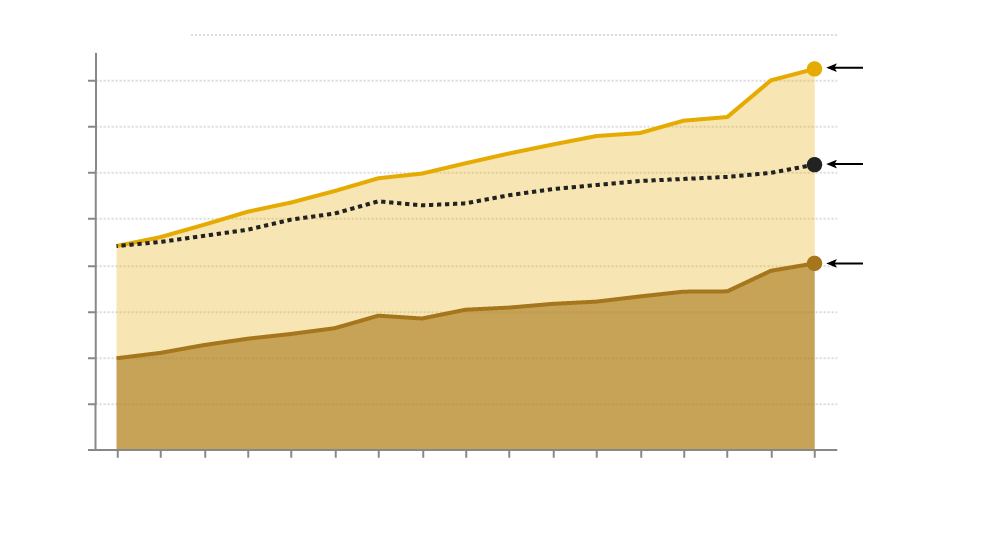

. Missoula County Community and Planning Services. Missoulas problems are even worse when compared to property tax increases nationally which increased at an average rate of 32 between 2016 and 2020. Taxation of real property must.

Add in a personal property tax rate of 016 percent and that brings up the total cost to 19045. 4 hours agoAfter nearly nine hours and at 3 am the Missoula City Council on Tuesday morning adopted the Fiscal Year 2023 budget including several amendments that squeaked in at the final hour. Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city limits.

For fiscal year 2023 city taxes will be 43095 per 100000 taxable value. The median home sales price increase that Missoula saw in 2021 was the largest of any single year on record going back multiple decades. So we did not increase taxes during the pandemic and they actually.

If you are sending your payments in by mail address them To. Include Taxpayer ID with payments. A citys real estate tax rules must comply with Montana statutory rules and regulations.

1 be equal and uniform 2 be based on current market worth 3 have one appraised value and 4 be considered taxable in the absence of being specially exempted. You are visitor 5046812. The value of your property directly affects the property taxes you pay to schools Missoula County and the City of Missoula.

Thats more than double the rate of the house with the smallest increase in our analysis house three. Missoula County Public Works. City taxes on a home with an assessed market value of 100000 will increase to 431 a jump of 4499 over the prior year.

Missoulas problems are even worse when compared to property tax increases nationally which increased at an average rate of 32 between 2016 and 2020. Find Information On Any Missoula County Property. Missoula County Detention Center.

The assessed market value is set by. Missoula County Animal Control. Fork Inn property at 1010 W.

The Department of Revenue a division of the State of Montanas government determines the market value of residential and commercial property once every two years. Some contend the state is strangling local governments while simultaneously not funding vital services. Missoula County Courthouse Annex.

The Missoula County Board of Commissioners adopted Tuesday the countys budget for the 2021 fiscal year which includes a slight increase to property taxes to fund costs and programs relating to equity affordable housing criminal justice reform and sustainability. The city unveiled Mayor John Engens proposed 2023 budget Wednesday morning in a committee meeting setting forth an 1159 tax and assessment increase for Missoula property owners. Average Missoula County home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes.

1 hour agoThe report found the number of first and second-grade students who scored below reading benchmarks in the fall of 2021 hit historic highs at 365 percent and 422 percent respectively. If we had other tools to use to fund these. Ad Find Missoula County Online Property Taxes Info From 2022.

Missoula mayor proposes property tax hike to pay for 385 percent increase in city spending. The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700. In fact if you took that homes property taxes in 2016 and applied the national.

The median property tax in Palm Beach County Florida is 2679 per year for a home worth the median value of 261900. Missoula property tax increase Tuesday June 28 2022 Edit. Owners must also be given a timely notice of rate hikes.

Missoula County Administration Building. MIssoula County Grants Community Programs. Thats around an 11 increase from last year.

Meanwhile the state is sitting on a budget surplus of more than 1 billion. Overall the total general fund in Missoula will increase by about 675100 with a 433000. Missoula County has one of the highest median property taxes in the United.

Missoula County has one of the highest median property taxes in the United States and is ranked 374th of the 3143 counties in order of median property taxes. County Services City of Missoula home 0 overall increase for county services andvoter-approved bonds Missoula County home 1021 increase for county services and voter-approved. The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700.

The local marijuana tax approved by Missoula County voters netted the city just 350000 in this budget cycle. 6 hours agoMISSOULA - While Missoula County hasnt yet unveiled its new budget frustrations over the City of Missoulas Fiscal Year 23 budget ran high on Monday with its proposed tax increase of more than.

Deferring Your Property Taxes In Bc Property Tax Tax Tax Payment

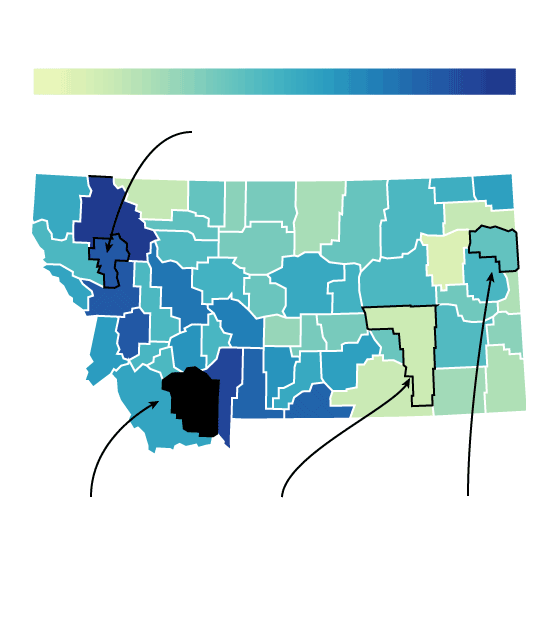

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Montana Property Tax Calculator Smartasset

Property Taxes Missoula County Blog

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Property Management Safety As A Property Manager Or Landlord You Have A Responsibility To Kee Property Management Being A Landlord Rental Property Management

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Reappraisal Reality Flathead Property Values Taxes Going Up Daily Inter Lake

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Us Interstate 75 Map Interstate 75 Sault Ste Marie Michigan Map

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Property Taxes Missoula County Blog

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Property Taxes Missoula County Blog

Proposed 2022 Initiative Would Cap Montana Property Taxes Assessment Values